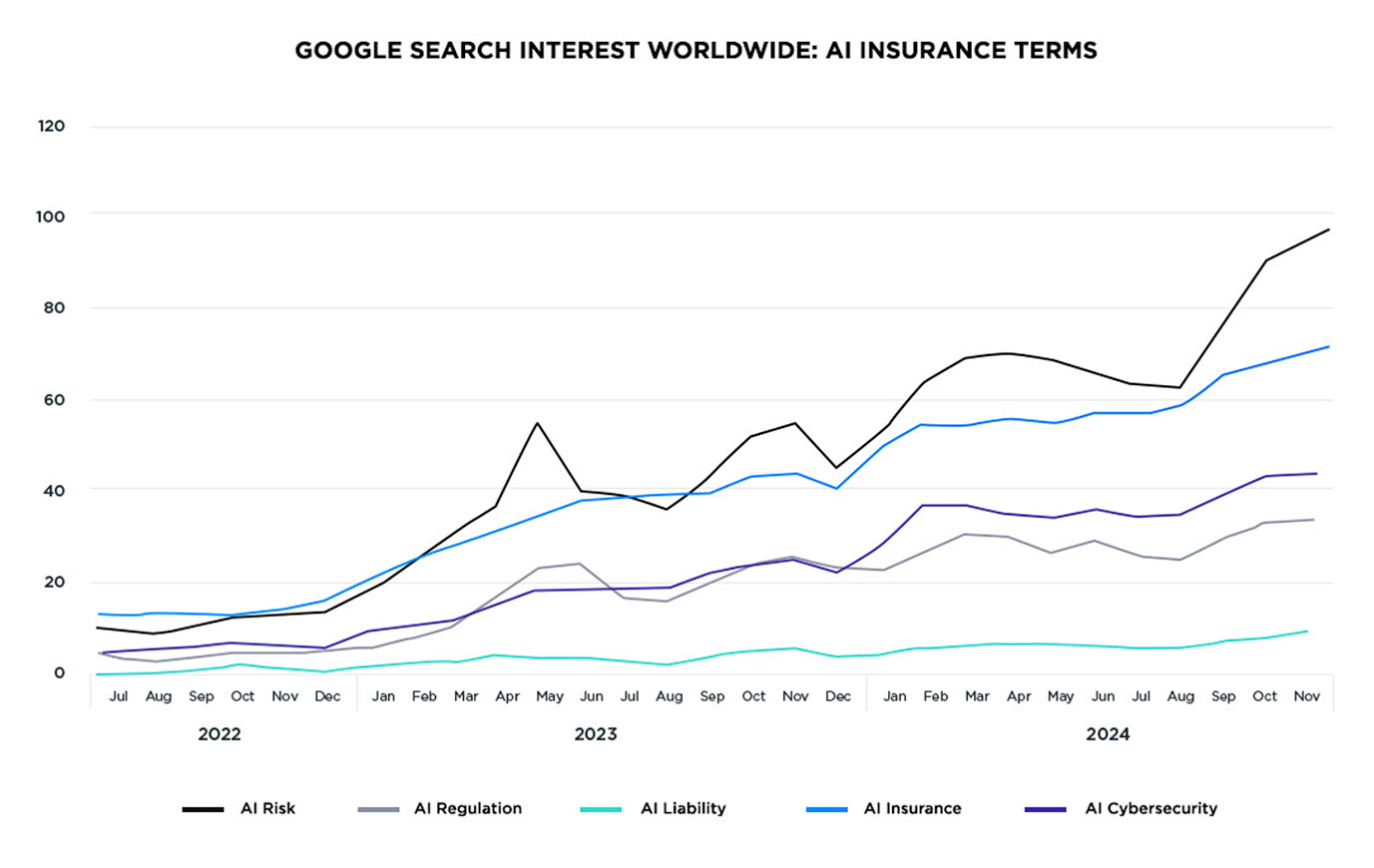

Google search data shows that interest for many AI-related risk terms are growing at an unprecedented rate.

For insurers, like Relm, this shift presents an opportunity to better meet our clients’ needs, by meeting demand for coverage that protects against AI-specific liabilities.

As businesses adopt AI technologies at an accelerating pace, the need for specialized insurance solutions is more urgent than ever. Relm is addressing this gap with innovative AI-focused solutions that offer protection against exposures traditional policies often exclude.

We’ll explore some of their benefits here, with deeper dives to come, and explain why we believe they will help our clients to innovate.

How Will AI Affect the Insurance Industry?

In 2024 FYQ2, over 40% of S&P 500 companies mentioned AI on their earnings calls. To get an idea of how that differs to previous years, FactSet created the below visualisation.

With AI’s rapid adoption has come a wave of new risks, from technical failures to ethical dilemmas. Businesses deploying AI face exposure to a myriad of liabilities, with the below being only a snapshot:

- Deepfake content: AI-generated media causing reputational harm or legal disputes.

- Discrimination concerns: AI-driven algorithms accused of bias in hiring, lending, or service decisions.

- Privacy breaches: AI tools mishandling sensitive data, violating privacy laws like GDPR.

- IP infringement: AI tools creating content or products that unintentionally infringe on copyrights.

Lawsuits against companies for biased AI hiring practices are already making headlines, and regulatory scrutiny is increasing globally. Which begs the question, how are companies protecting themselves from this risk?

Bridging the Gaps: Relm’s AI Insurance Solutions

While cyber insurance products are adapting, many traditional liability policies may exclude the emerging risks associated with AI – or remain ominously silent.

Relm Insurance has developed a suite of products —NOVAAI, PONTAAI, and RESCAAI —to bridge these gaps.

Each of these are covered in separate articles with context around real-world impact and risk scenarios, but a brief overview of functionality is below.

- NOVAAI: Focused on liability and cybersecurity risks for AI platform companies and AI technology developers.

- PONTAAI: Provides excess liability coverage for scenarios where existing policies fall short.

- RESCAAI: Offers first-party response coverage for organizations embedding third-party AI in their operations.

“AI has introduced a new category of risks that traditional policies simply aren’t addressing adequately,” explains Claire Davey, Relm’s Head of Product Innovation and Emerging Risk. “Our solutions affirmatively speak to these exposures, helping businesses stay resilient in an evolving digital landscape.”

Why Companies Need Specialized AI Coverage

The urgency for AI-specific insurance stems from the sheer complexity and ambiguity of AI liabilities.

For instance, commercial crime coverage often includes coverage for ‘social engineering’, i.e. phishing scams to ply confidential information and money from employees, but policies rarely account for the full spectrum of AI-related risk.

Many CEOs would be reasonably confident that a new finance employee wouldn’t transfer company funds from a phishing scam. But what if that same employee wasn’t simply sent an email, but told to do so by senior management in a video conference call?

That exact scam was orchestrated in February 2024 in Hong Kong using deepfake recreations and cost a multinational company $25 million.

Not all scenarios involve fabricating anthropomorphic AI personas; instances like those below can be much simpler.

- A manufacturing firm uses an AI system for quality control, but a software failure leads to a major product recall, causing financial and reputational damage.

- An AI-driven chatbot misinterprets customer input, resulting in a personal injury claim.

Incidents like these can result in significant financial losses, regulatory fines, lawsuits, and reputational harm. With AI increasingly embedded in core operations across industries, businesses need robust coverage to safeguard against these risks.

The Future of AI Insurance, AI Liability, and AI Cybersecurity with Relm

“AI represents both an opportunity and a challenge for businesses,” says Joseph Ziolkowski, CEO of Relm Insurance. “As an enabling factor, our objective is to provide innovative insurance coverage to companies embracing cutting-edge technology like AI, giving them the freedom to responsibly push boundaries while minimizing the impact from unexpected liabilities.”

As technology continues to evolve, so too will the risks it brings. Relm is committed to staying ahead of the curve, providing solutions that address tomorrow’s challenges today.